The complex structure and large ticket sizes of minimum investment capital units translates to high barrier to entry for traditional project finance; with consequences that retail investors have been excluded from investing in impactful capital-intensive infrastructure projects. Compounding the funding access and liquidity problems is the shalowness, incompleteness and jusridictional localization of capital markets and exchanges in emerging economies

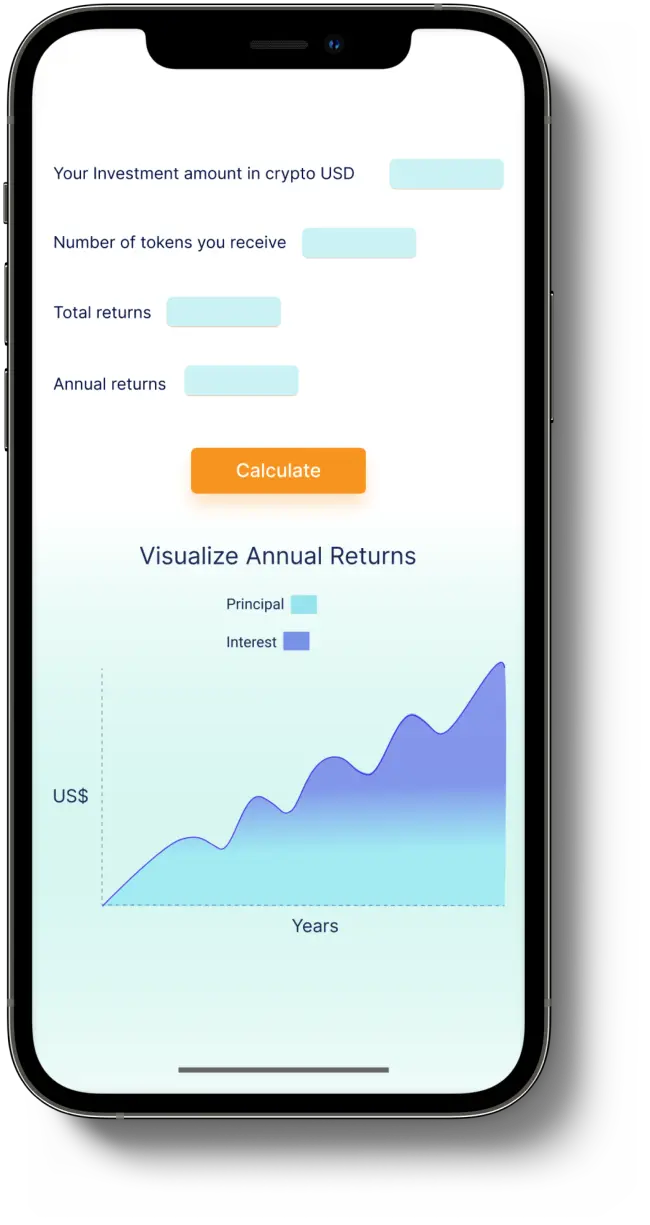

InfraTrade tokenize and fractionalizes capital-intensive assets for investors, enabling them to contribute any amount of funds in the project and easily trade those investments later to interested parties in an open secondary and higher-order market

Express an interest in being a crowdinvestor by joining wait list

Once crowdfunding campaign go live (i.e. are listed) investors can contribute debt finance for particular projects. Crowdinvestor will provide debt or loans for the project by purchasing debt security tokens

Once the campaign target is reached, the project is delisted on the platform. At this stage, the project is considered to have reached financial close, securing all the funds needed for construction

The developer constructs the project in a timely manner, using the funds provided by the investors

Once the project acheive commercialization, the output is sold to the end-users and offtakers. The crowd investor revenues are remitted to a smart contract that autonomously pays out at predetermined intervals. Investors return are based on their initial contributions and includes a stable interest payment. Importantly, investors can exit their investments at any time by auctioning their debt security tokens on the secondary market.

Know when crowdfunding campaigns go live